Ship Recycling Market Update: Rising Charter Rates and Ongoing Tonnage Shortage

Charter rates in the dry bulk carrier industry, particularly in the Capes and Panamax sectors, have continued to climb, according to reports from cash buyer GMS. This trend has led to an ongoing shortage of tonnage, which has become increasingly apparent at recent bidding tables.

Despite the rising rates, local port positions are still reporting healthy arrivals and deliveries following a recent fire sale that saw both Bangladeshi and Indian waterfronts bustling with activity.

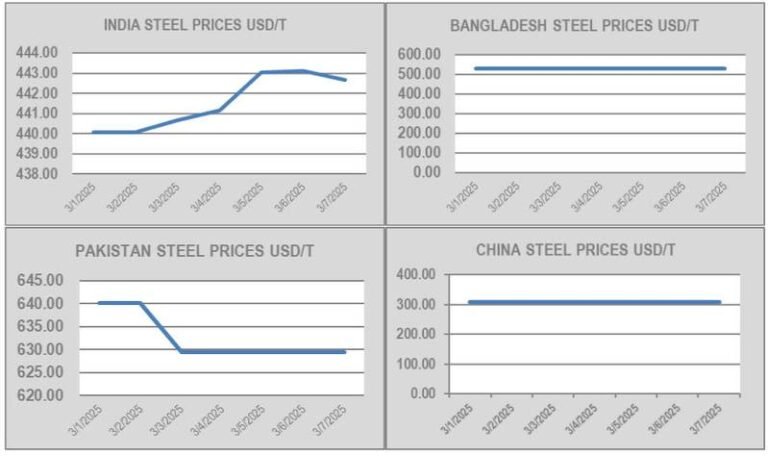

“Q1 2025 has proven to be a turbulent time, with over USD 150/LDT wiped off vessel highs since January 2024. Economic and trade pressures are pushing vessel prices down, dampening sentiments and aggression from ship recycling destinations,” stated a GMS representative.

The ability of ship recyclers to be aggressive in the current market is being limited, affecting global residual values of recycling candidates. This is in stark contrast to the supply surge witnessed in January, followed by fluctuating supply levels since February.

Against a backdrop of mounting geopolitical pressures, ship recycling sales have slowed down significantly. Most yards are focusing on recycling recent deliveries, while tier-2 recyclers are waiting for opportunities to secure low-priced deals, helping to sustain demand despite fluctuating prices.

In Bangladesh, political protests and clashes are on the rise, while Indian recyclers are gradually aligning their prices with Pakistani levels, inadvertently making the Pakistani market more active and pushing India into second place.

Meanwhile, Turkey has reported no significant changes in its ship recycling market, despite a surprising sale surfacing recently.

Overall, ship recycling yards are busy upgrading their facilities in preparation for the entry into force of the Hong Kong Convention on June 26.