Chevron Clears Hurdles to Complete Hess Corporation Merger

U.S.-headquartered energy giant Chevron has cleared all the hurdles in its path to bring Hess Corporation, a fellow oil and gas player, into its fold. As a result, the companies are taking steps to blend their operations, enabling Chevron to expand its oil and gas arsenal, with four regions pinpointed as the ones where this merger will have the strongest impact.

With the arbitration proceedings that followed in the wake of Chevron’s $53 billion all-stock deal to acquire Hess Corporation, now out of the way, the U.S. player is the new partner in Guyana’s Stabroek block, where ExxonMobil and CNOOC are its partners. The Hess acquisition is Chevron’s third upstream deal since 2020, following Noble Energy in 2020, REG in 2022, and PDC Energy in 2023.

Previously, ExxonMobil and CNOOC initiated the arbitration process, as they believed they should have a right to a first refusal over any sale of Hess’ 30% interest in Guyana’s oil-rich offshore block under the existing joint operating agreement. This delayed the Chevron-Hess merger, originally announced in 2023, dragging the business combination closure date into 2025.

Despite obstacles in its path, the U.S. duo still managed to progress the merger by securing Hess stockholder approval and clearing the Federal Trade Commission (FTC) antitrust review, convinced that preemptive rights in the Stabroek block joint operating agreement do not apply.

Following the arbitration win, Chevron highlighted: “With the merger complete, Chevron and Hess are moving forward with integrated operations—and looking forward to a quick, efficient transition. When two companies come together, the result should be more than just bigger—it should be better, too.

“With Hess joining Chevron, the company can now capitalize on a combined 240 years of experience. The merger broadens Chevron’s resource base and will help Chevron continue working to meet the world’s growing demand for energy.”

Impact of the Merger

The four regions where this merger will have the most impact have been identified as Guyana, Bakken, the Gulf of America (formerly known as the U.S. Gulf of Mexico), and Southeast Asia. While describing Guyana as “a world-class offshore resource,” Chevron claims that the Stabroek block is one of the top oil discoveries of the 21st century.

The U.S. player explains that this block in the Atlantic Ocean, off the coast of Guyana, contains highly desirable crude oil that is cost-effective to refine. The company now has 30% ownership in the region, which has more than 11 billion barrels of oil equivalent discovered recoverable resources.

Moving from Guyana to America, the firm explains that Hess has a longstanding presence in North Dakota’s Williston Basin, home to the prolific Bakken Formation, perceived as a top source of U.S. shale oil production.

When this is added to the Permian and DJ Basins, where Chevron operates, the company’s shale and tight portfolio now exceeds 2.5 million net acres in some of the most prolific onshore oil-producing regions in North America.

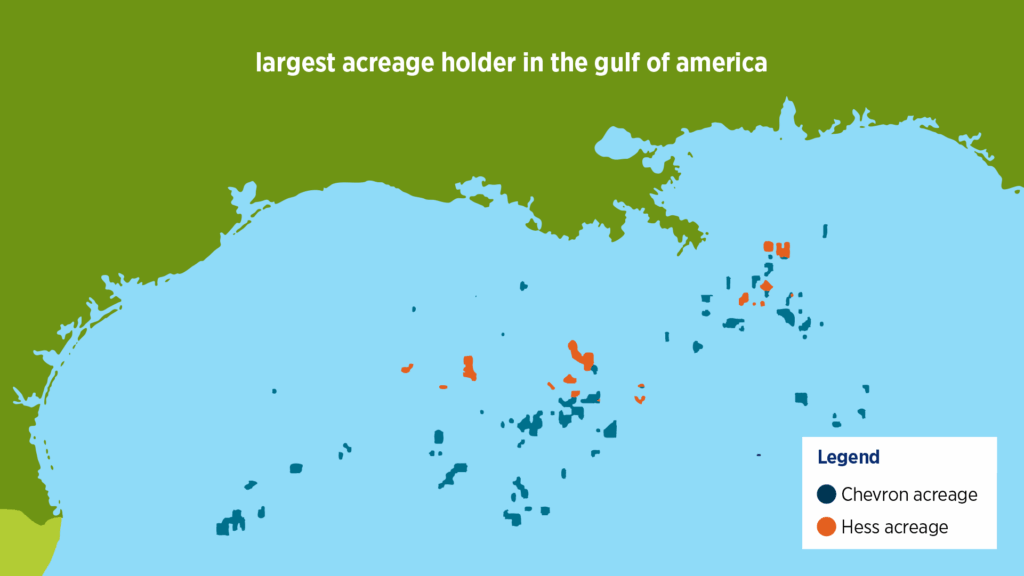

Shifting the focus to the Gulf of America, which is another strategic region, the U.S. firm emphasizes that it has now become the largest acreage holder, with access to global shipping lanes and the U.S. Gulf Coast, said to be one of the world’s largest energy markets. Before this business combination, Chevron and Hess had been partners in deepwater assets for many years.

Moreover, the Hess acquisition enables Chevron to take over the former’s natural gas assets in Southeast Asia, including Malaysia, where the firm has been present since the 1930s. The company also has exploration and production assets in Thailand.

With the merger now complete, the U.S. giant has underlined that it is moving forward with integrating operations to build on Hess’s history in the regions where it was active, ensuring “a smooth transition and maintaining focus on safe and responsible operations.”