The Bureau of Ocean Energy Management Announces Proposed Oil and Gas Lease Sale 262 in the Gulf of America

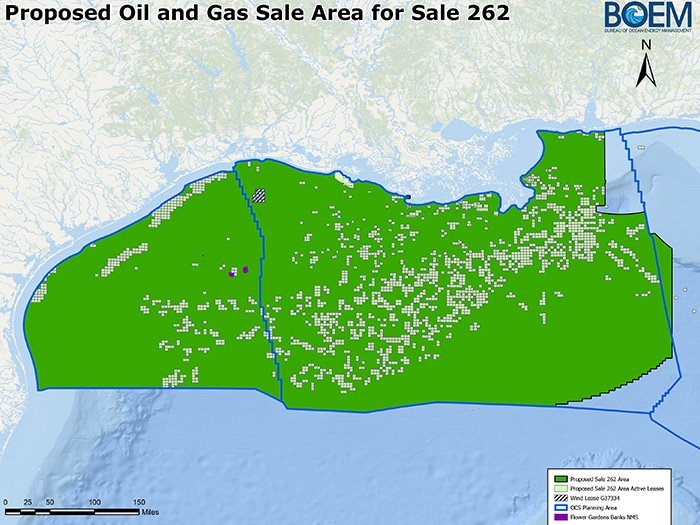

Proposed are of oil and gas Lease Sale 262 [Image: BOEM]

The Bureau of Ocean Energy Management yesterday announced the publication of a Proposed Notice of Sale (PNOS) for an oil and gas lease sale in the Gulf of America. Lease Sale 262 will offer approximately 15,000 unleased blocks located 3 to 231 miles offshore across the Gulf’s Western, Central, and Eastern Planning Areas, covering roughly 80 million acres.

These blocks are situated in water depths ranging from 9 feet to more than 11,100 feet (3 to 3,400 meters). BOEM is proposing a royalty rate of 16 ⅔ percent for both shallow and deepwater leases—the lowest rate for deepwater since 2007, to encourage robust industry participation and lower production costs.

The Notice of Availability for the PNOS will be available for public inspection in the Federal Register on June 26, 2025, and officially published on June 27, 2025. The publication will initiate a 60-day comment period for affected state governors and local governments.

Following the comment period, BOEM will issue a Final Notice of Sale in the Federal Register at least 30 days before the scheduled public bid reading, proposed for December 10, 2025. The lease sale bid reading will be live streamed via Zoom.

Lease Sale 262 is the first of three planned lease sales in the Gulf under the 2024–2029 Outer Continental Shelf Oil and Gas Leasing Program. BOEM is also developing a new National Outer Continental Shelf Oil and Gas Leasing Program that will include additional leasing opportunities.

The Gulf of America Outer Continental Shelf is estimated to contain around 48 billion barrels of undiscovered, recoverable oil and 141 trillion cubic feet of natural gas, making it a strategic energy region.

Leases awarded through Lease Sale 262 will be for oil and gas exploration and development only. Certain areas may be excluded from this lease sale, including blocks subject to the presidential withdrawal, blocks adjacent to the U.S. Exclusive Economic Zone, and blocks within marine sanctuaries.

Offshore development generates revenue from lease sales, rental fees, and royalties, benefiting the U.S. Treasury and states through revenue sharing programs that fund conservation and public services.

Conclusion

Lease Sale 262 marks a significant step in unlocking the energy potential of the Gulf of America. It reaffirms America’s commitment to offshore energy leadership and sets the stage for continued investment, innovation, and responsible development in the region.