The Evolving Landscape of Global Energy Investment

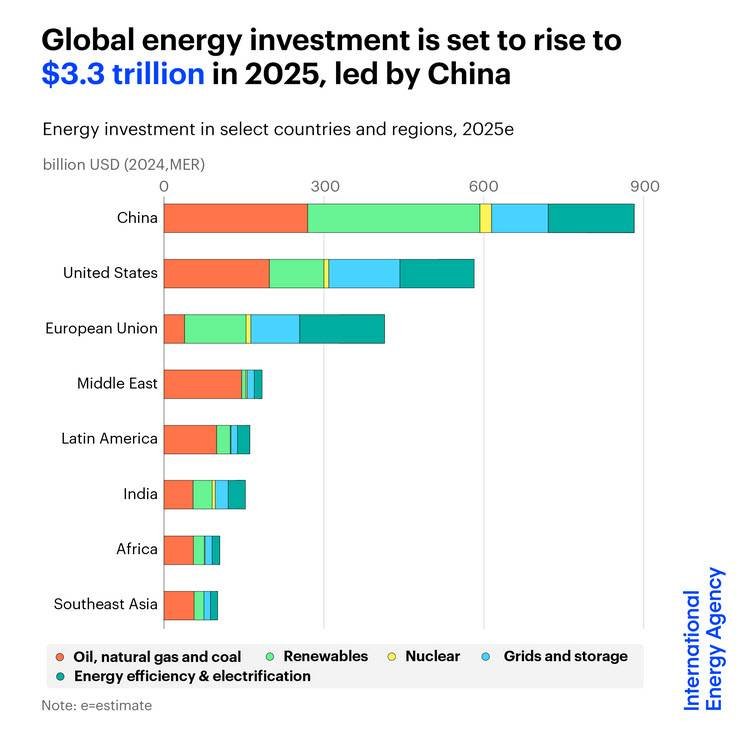

The latest edition of the International Energy Agency’s World Energy Investment report sheds light on the shifting dynamics of energy investment on a global scale. A stark contrast to the scene depicted in the inaugural report in 2015, where China’s energy investment barely surpassed that of the United States, the current landscape tells a different story.

Today, China stands tall as the world’s largest energy investor, outspending the European Union by a factor of two and coming close to matching the combined investments of the EU and the United States. The country’s commitment to clean energy has seen its share of global clean energy investment rise from a quarter a decade ago to nearly one-third today.

The Rise of China and the Stabilization of the United States

While the United States witnessed a nearly twofold increase in spending on renewables and low-emissions fuels over the past decade, recent policy shifts are expected to plateau this growth. On the other hand, China’s dominance in clean energy investment continues to soar.

Shifts in Upstream Oil and Gas Investments

The report also highlights a significant shift in upstream oil and gas investments towards major resource holders in the Middle East. By 2025, the region’s share of global upstream investment is projected to reach a record high of 20%, while Russia’s share has dwindled to around 6% due to constrained spending.

Challenges in African Energy Infrastructure

Developing economies, particularly in Africa, are facing challenges in mobilizing capital for energy infrastructure. Currency depreciation and higher interest rates have hindered their ability to access and service debt, resulting in a 33% decline in energy investments in Africa since 2015. Despite accounting for 20% of the world’s population, Africa only receives 2% of clean energy investment.

Emerging Trends in India and Brazil

India and Brazil have emerged as standout performers among emerging economies, thanks to robust policy support that has fueled investments in solar, wind, and bioenergy projects. India is on track to surpass its 2030 target of 50% non-fossil generation capacity ahead of schedule, while Brazil is tapping into its vast offshore oil reserves.

Southeast Asia’s Role in Clean Energy Supply Chains

Although Southeast Asia lags behind in the deployment of emerging technologies, the region is carving out a niche in clean energy supply chains. Second only to China in solar manufacturing, Southeast Asia, particularly Indonesia, is making strides in the production of key resources like nickel.

Outlook for Global Energy Investment

Despite challenges posed by geopolitical tensions and economic uncertainties, global energy investment is poised to reach a record $3.3 trillion by 2025. The report underscores the resilience and dynamism of the energy sector in adapting to evolving trends and demands.