The Rise of Floating LNG Terminals: A Game-Changer in the Global LNG Market

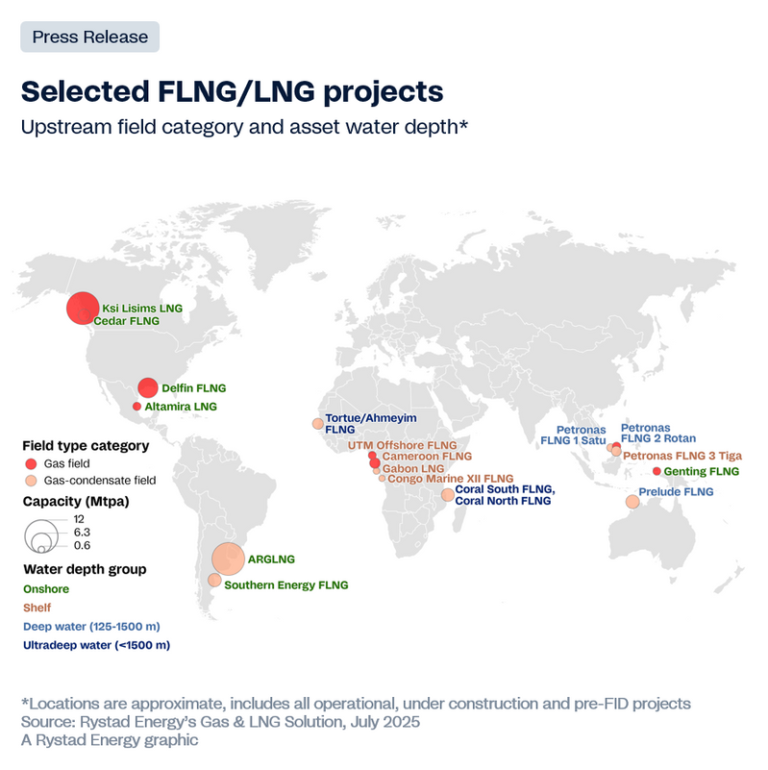

Floating liquefied natural gas (FLNG) terminals are revolutionizing the global LNG market, with their capacity expected to triple by 2030, as per research from Rystad Energy. Overcoming initial technical and operational challenges, FLNG projects are now matching the utilization rates of traditional onshore terminals. With the demand for LNG on the rise and the feasibility of tapping into smaller gas fields, FLNG is emerging as a more agile, cost-effective solution capable of adapting to dynamic market conditions and unlocking previously inaccessible reserves.

Projected Growth in FLNG Capacity

Rystad Energy predicts that global FLNG capacity will reach 42 million tonnes per annum (Mtpa) by 2030, surging to 55 Mtpa by 2035, nearly four times the capacity recorded in 2024. Terminals commissioned before 2024 achieved impressive utilization rates, comparable to onshore LNG facilities, showcasing the increasing efficiency and reliability of FLNG technology.

Technological Advancements and Cost Efficiency

Early FLNG projects faced challenges, such as the costly construction of Shell’s Prelude in South Korea. However, the industry has learned from these experiences, leading to a significant reduction in capital expenditure per tonne. Proposed projects along the US Gulf Coast now boast lower costs, with vessel conversions proving to be a cost-effective alternative to newbuild facilities.

Operational Flexibility and Mobility

FLNG vessels offer operational flexibility across various environments, from deepwater to onshore supply. In case of project delays, these vessels can be relocated or sold, highlighting their mobility and adaptability. This flexibility allows for quicker decision-making and faster revenue generation, crucial in the current energy landscape.

Accelerated Project Timelines

Rystad Energy data indicates that FLNG units can be delivered faster than onshore liquefaction facilities, reducing construction timelines and minimizing cost overruns. The average build time for new FLNG projects is approximately three years, compared to 4.5 years for onshore plants. This expedited timeline is driving the growing preference for FLNG as developers aim to maximize returns swiftly.

With the increasing demand for LNG and the need for more efficient and adaptable solutions, FLNG terminals are poised to play a pivotal role in shaping the future of the global LNG market. As technology advances and costs decrease, FLNG presents a promising opportunity to meet the evolving needs of the energy industry.