The Future of Offshore Wind Energy: A Look Ahead to 2025

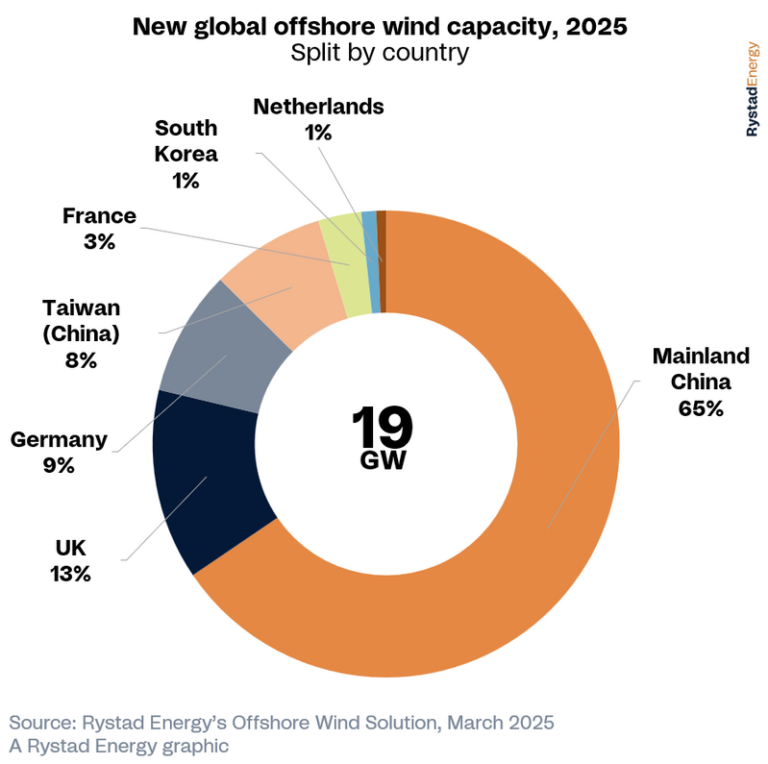

The global offshore wind industry is on the brink of a significant rebound in 2025, with projections indicating capacity additions reaching a substantial 19GW. Research from Rystad Energy suggests that sector-wide expenditure could soar to $80 billion, signaling a promising resurgence for the industry.

Factors Driving the Recovery

After experiencing a slight slowdown towards the end of the previous year, where new installations dipped to around 8GW (a 2GW decrease from the year before), the industry is now gearing up for a robust comeback. A record wave of lease auctions is fueling this resurgence, with mainland China, the world’s largest offshore wind market, accounting for a significant 65% of new capacity additions.

This surge in capacity is expected to surpass previous peaks, exceeding the 7.7GW added in 2024, 10.2GW in 2023, and 9.3GW in 2022. The total additions forecasted for 2025 are set to outpace these figures by about 1GW, showcasing the industry’s potential for growth.

Global Lease Auctions and Offered Capacity

In 2024, a record 55GW of offshore wind capacity was offered in lease auctions globally, excluding mainland China. However, not all of this capacity has been awarded yet, as the transition from offered to awarded capacity is not always seamless. For instance, the US witnessed no bids for its 3GW floating wind auction in Oregon last year.

Despite the record offerings in 2024, lease auction openings are projected to decline in 2025, with an estimated 30-40GW up for grabs. While this figure is lower than the previous year, it still represents a significant opportunity for industry players, aligning with levels seen in 2021 and 2022.

Challenges and Opportunities Ahead

While the outlook for offshore wind in 2025 appears promising, there are potential challenges on the horizon. US federal policy decisions, such as the memorandum halting new leasing and approvals on the Outer Continental Shelf, could create uncertainty and hinder development in key markets.

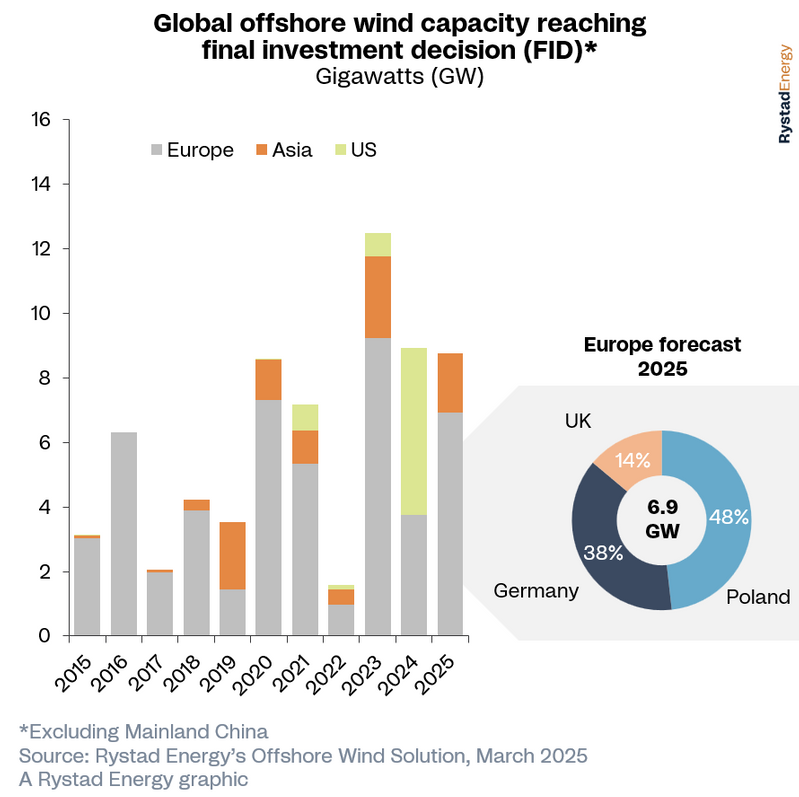

Project delays in 2024 impacted final investment decisions for new offshore wind projects, leading to a decline in project approvals. However, there are bright spots on the horizon, with projects like Red Rock Power and ESB’s Inch Cape in the UK and Equinor’s Empire Wind 1 in the US moving forward.

Regional FIDs and Growth Prospects

The UK, Poland, and Germany are expected to lead a surge in European FIDs in 2025, with several projects in these countries poised for final approval. Poland, in particular, is anticipated to see major wind farms like Baltyk II and III reach FID, following the recent approval of projects like Baltica 2.

With a mix of challenges and opportunities on the horizon, the offshore wind industry is primed for growth in 2025. As capacity additions and sector-wide expenditure climb to new heights, the future looks bright for this vital sector of the renewable energy landscape.