Global Petroleum Extends Timeline for Farm-In Agreement in Namibia

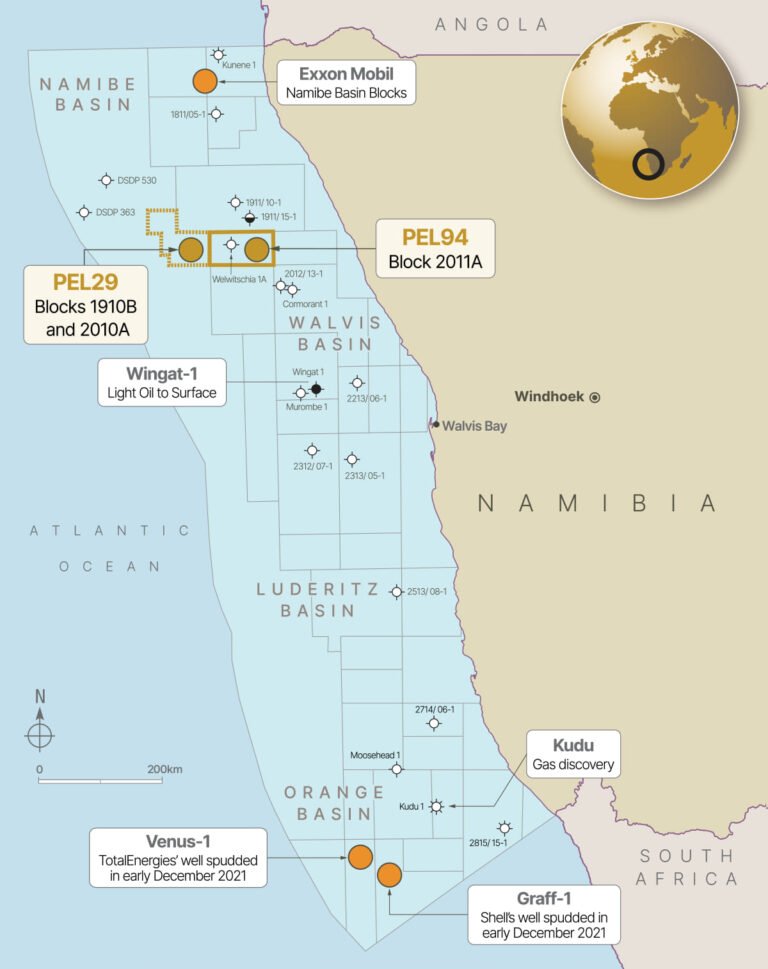

Global Petroleum, an AIM-listed oil and gas upstream exploration company, has decided to extend its timeline to secure a farm-in agreement for its petroleum exploration license (PEL) 94 in Block 2011A in the Walvis Basin, off the coast of Namibia.

After initial hydrocarbon discoveries, Namibia has become an exploration hotspot, attracting interest from potential partners for Global Petroleum’s PEL 94. The company has been in discussions with undisclosed ‘well-known’ companies in the oil and gas industry to finalize a farm-in deal.

While commercial discussions with a potential partner began in August 2024, Global Petroleum has extended the deadline for the farm-out deal beyond December 31, 2024. The company reports renewed and new interest from industry players, highlighting the attractiveness of PEL 94.

“Our priority is to evaluate all available options thoroughly to secure the most advantageous terms for the company and its shareholders,” emphasized Global Petroleum.

The AIM-listed firm aims to conclude the transaction at the earliest opportunity with beneficial terms. PEL 94 covers 5,798 square kilometers in water depths ranging from 450 to 1,550 meters.

NAMCOR holds a 17% interest in PEL 94, and Aloe Investments Two Hundred and Two has a 5% interest. A strategic partner is expected to enable the exploitation of the estimated 2,747 billion barrels of oil on the license.

Omar Ahmad, CEO of Global Petroleum, stated: “We are committed to exploring all opportunities and securing the best deal for our shareholders. The interest from well-known companies is a testament to the potential of PEL 94.”

“This strategic decision allows us to achieve the most beneficial outcome for the company. We appreciate the patience and support of our shareholders as we continue to work on this important transaction.”

Challenges and Successes in Namibia’s Offshore Exploration

Namibia’s offshore drilling sector offers promise but comes with risks. Recent drilling activities by oil majors like Shell and Chevron have shown mixed results. Harmattan Energy, a Chevron subsidiary, did not find commercial quantities in Namibia’s Orange Basin, while Shell faced challenges at PEL 39.

Shell’s $400 million write-down was due to technical and geological difficulties in confirming the commercial viability of its oil discovery in the Orange Basin. Despite setbacks, Namibia’s offshore remains a compelling prospect for oil and gas exploration.