Contemplating a Shift in EU Energy Policy: MSI Considers the Possibility of Reviving Energy Ties with Russia

London-based consultancy MSI has contemplated the possibility of a shift in energy policy within the European Union (EU), where the EU changes its mind about the ban on Russian fossil fuels and decides to take a page out of U.S. President Donald Trump’s book by reviving its energy ties with Russia against the backdrop of trade wars, geopolitical challenges, and other brewing and ongoing storms on the global horizon.

Given the frequency of unexpected changes worldwide, MSI is of the opinion that nothing can be ruled out in the current global climate; thus, it decided to ponder what would occur if the European Union did a Donald Trump and reversed its energy rulebook, as a peace settlement in Ukraine could bring ripple effects across the energy industry, potentially returning Russian barrels to Europe.

As a result, the London-based consultancy, which portrays the U.S. adoption of a more conciliatory and accommodative position towards Russia as perhaps the wildest of all the cards being played in a fast-changing and unpredictable world, wonders whether the tanker segment should prepare for such a scenario, as it has the potential to create a major dent in earnings for the sector, according to Tim Smith.

In light of this, the UK firm warns that the lessening of sanctions on Russia could potentially create a sizeable hit to tanker market earnings, aided by the negative market impacts from an end to Red Sea diversions, tariffs, and U.S. port call fees.

MSI’s scenarios in which a settlement is reached quickly spotlight two burning questions, focusing on whether Europe would resume Russian oil imports and what would become of the gray fleet, also known as the shadow fleet.

MSI underlined: “Europe’s position is unlikely to change as quickly as the US, both due to the consensus nature of European politics, the perceived and proximate threat from Russia and probably more sceptical view on Russia’s underlying motives, given its role as the aggressor in Ukraine.

“However, given the fast-moving and unpredictable geopolitical environment, ruling things out seems less sensible than considering them. Furthermore, if some form of detente and/or accommodation were made between the West and Russia, the requirement for the use of the dark/grey fleet would likely markedly diminish.”

Therefore, the British company’s range of scenario drivers, although not necessarily likely, are moving within the envelope of possibility, at least across the full forecast period; thus, it looks at oil trade from Russia to Europe, including seaborne crude oil and refined product flows to Europe.

While these have dropped dramatically since the start of the war in Ukraine, some crude still moves from this region to southern Europe, mainly Kazakh barrels. Under MSI’s base case scenario, Russian oil does not return to Europe.

In the alternative scenario, the firm posits a resumption in this trade in two years, thanks to a negotiated peace in Ukraine, thawing relations between Russia and Europe in 2026, and leading to an energy agreement in 2027.

Even though it perhaps seems unlikely, given the current cards on the table, MSI points out that such a ‘what if’ scenario is not out of the realm of possibility, as previously demonstrated in geopolitics, since an unexpected shift appears to be happening more frequently.

With this in mind, the company claims that in this scenario, the world would see a rapid return of Russian barrels to Europe, effectively reversing the demand support that has been factored into the market since 2022 as a result of the re-routing of Russian oil to longer-haul destinations and the mirrored requirement for European importers to source oil from elsewhere.

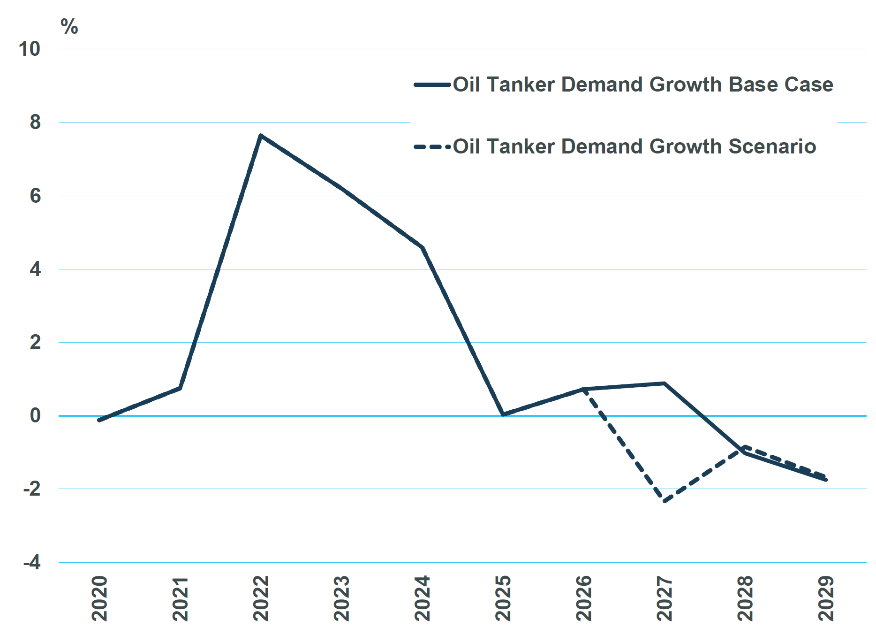

If these trends undergo a reversal, MSI predicts a hit in demand. While the firm’s base case scenario projects oil tanker demand growth for crude and products combined in 2027 at 0.9%, the imposition of the scenario in which Russian barrels would fully return to the European market is predicted to bring a sizeable decline in demand of 2.3%.

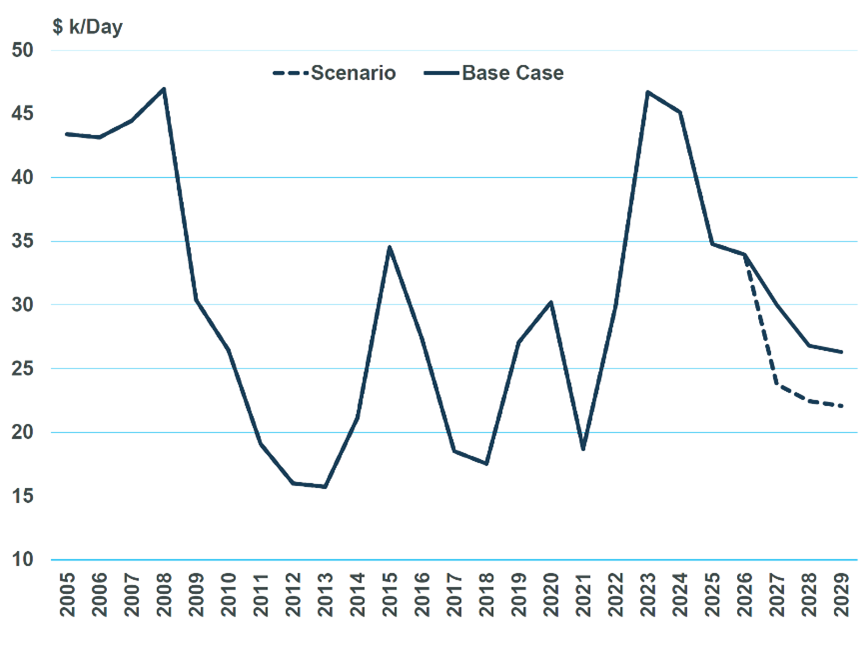

Moreover, MSI sees a ‘swing factor’ of just over 3% in the market due to Russia-Europe ‘avoidance.’ The company’s estimated impact on tanker earnings of this Russia/Europe scenario for Suezmax tanker one-year T/C rates shows that the market returns to pre-war levels.

Follow Offshore Energy’s Fossil Energy market on social media channels: