Six offshore drilling players – Transocean, Noble Corporation, Valaris, Seadrill, Shelf Drilling, and ADES – have reported a combined total backlog of $31.17 billion in the first quarter of 2025. This comes at a time when Westwood, an energy market intelligence research firm, paints a picture of a freeze in the rig demand and forecasts a ramp-up in the rig retirement trend, with marketed utilization said to be at the lowest levels since the start of the recovery period in 2021.

According to Teresa Wilkie, Westwood’s Director of RigLogix, the offshore rig market recovery has seemingly taken a break, with a slump in demand and marketed utilization reaching the lowest levels recorded since recovery began in 2021 due to a variety of factors, including Aramco’s suspension of over 30 jack-up contracts by up to one year, the entry of newbuild rigs into the market without work to go to, and the deferment of several long-term deepwater drilling and plug and abandonment (P&A) projects.

This reportedly unexpected combination of a dip in firm demand, which saw an 18% drop versus March 2024, and a boost in supply of 7% compared to March 2021, is said to have resulted in marketed utilization fall to 88% as of March 2025, representing a 6% decrease in less than two years. The company claims that attrition this year is the highest since 2022, predicting utilization of the combined jack-up, semi-submersible, and drillship segments to fall further to around 85%.

With this in mind, Wilkie underlines that more rigs are likely to be permanently removed from the active drilling fleet as the year progresses, since attrition began to pick up again as market softness started creeping in, especially in the UK sector of the North Sea semi-sub market, where four of the seven assets were retired. This year, nine rigs have been confirmed for removal from the active fleet, consisting of four jack-ups – owned by Shelf Drilling, White Fleet Drilling, and Well Services Petroleum – and three 8500-series semi-subs, owned by Valaris, all of which were under 15 years old.

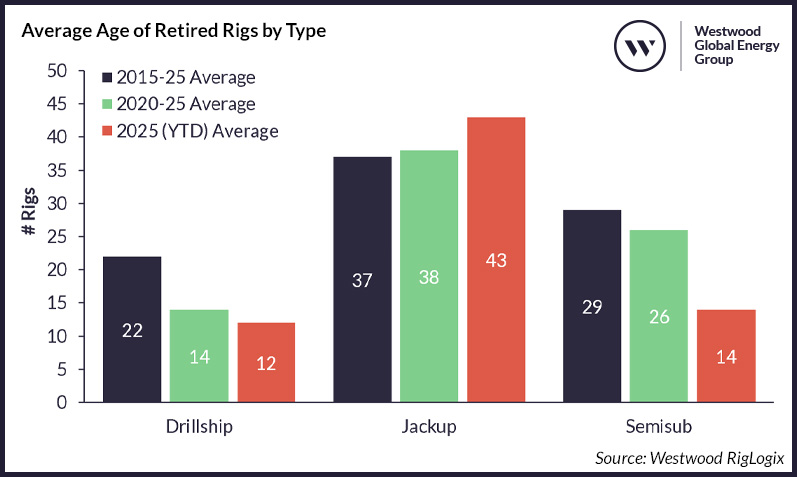

Aside from this, Noble announced the disposal of two modern S12000-design, ultra-deepwater drillships it inherited during its acquisition of Pacific Drilling, one of which never drilled a single well and was just ten years old. Westwood claims that the average age of assets retired from the fleet has continued to be downsized for floating rigs, with the age for drillships reducing by eight years over the last five years, and semi-subs by three years.

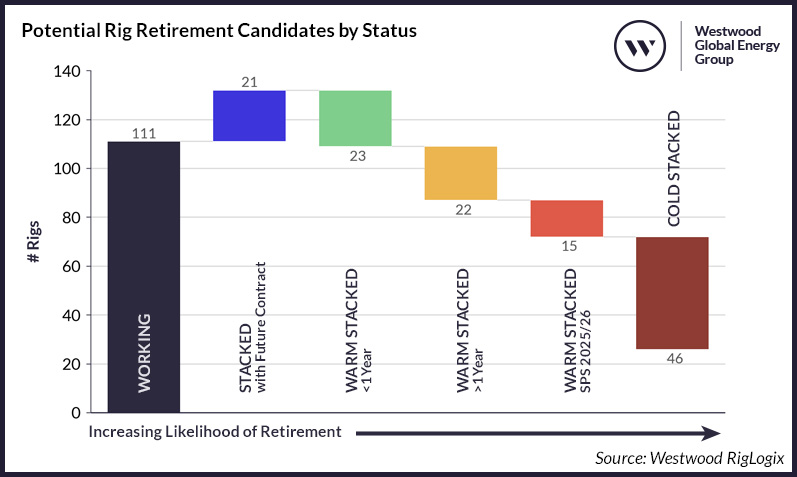

“Generally, rigs that have limited future prospects, have been without work or cold-stacked for some time (meaning a costly reactivation programme), and are due the often very expensive five-yearly special periodic survey (SPS), are also considerations. Other factors can be one-off designs in a contractor’s fleet, where they may not be able to spread spare parts costs etc, out-of-favour designs (as seen with the small variable deck load on the 8500-series semisub), and of course mergers between owners, which often enables easier culling decisions as owners look to streamline fleets,” elaborated Wilkie.

Regarding jack-ups, Westwood notes that 39 of these units are cold stacked and 19 are warm stacked – seven of them for over a year – but eight of these assets do not have a valid special periodic survey (SPS) in place, and three more will expire this year or next if not renewed. Most of the units included in the firm’s analysis are situated in the Middle East, India, or U.S. waters, with Shelf Drilling and Enterprise Offshore owning the lion’s share of these rigs.

Only five drillships are cold-stacked, all between 14 and 16 years old, while seven are warm or hot stacked units, none of which have been idle for more than a year, and four of these do not have a valid SPS, or it will expire in 2025 or 2026. The majority of the drillship candidates are perceived to be in Southeast Asia or the Mediterranean, with Transocean, Seadrill, Stena, Vantage, and Saipem owning the assets.

Last but not least, the pool of semi-sub candidates is said to be small, primarily because of the high level of attrition already undertaken in the segment over the past decade, which has resulted in the total supply of the fleet reducing by 59% to 119 rigs since March 2015, with only two cold-stacked and three warm-stacked assets, out of which only one of the warm units has been idle for over a year and, all but one rig, either do not have a valid SPS, or it will expire in 2025 or 2026.

Moreover, Wilkie underlines that two of these assets are in the landlocked Caspian, where bringing in new rigs is a challenge, making them less likely to be scrapped. The rest of these assets are currently in Las Palmas in the Canary Islands, the North Sea, or Canada and are owned by Dolphin Drilling, Well-Safe, and Transocean.

“With a disciplined approach to costs and capital allocation, we believe Seadrill is well-positioned to capitalize on the eventual recovery in the offshore drilling market.”

Shelf Drilling and ADES Holding: A Tale of Backlogs and Long-Term Value Creation

Shelf Drilling and ADES Holding, two prominent rig owners in the industry, have recently announced their backlogs and strategic outlook for the future. These figures, coupled with their proactive approaches and strong financial positions, set the stage for long-term value creation in a challenging market environment.

Shelf Drilling Wins Backlog of $1.6 Billion

As of March 31, 2025, Shelf Drilling’s backlog stood at $1.6 billion, reflecting a slight decrease from previous periods. The firm’s effective utilization dipped to 79% in Q1 2025, impacted by operational suspensions and contract completions. Despite these challenges, Shelf Drilling’s CEO, Greg O’Brien, emphasized the company’s operational efficiency and commitment to delivering safe and reliable services.

O’Brien stated, “With total fleet uptime of 99.4% for the quarter, we continued our strong level of operational efficiency from 2024, demonstrating the execution capabilities of our offshore and onshore teams. The recent macroeconomic developments have contributed to reduced commodity price levels and created some market uncertainty.”

Looking ahead, Shelf Drilling is focused on optimizing its cost structure, leveraging its unique operating platform, and capitalizing on contract opportunities in the coming years. O’Brien expressed confidence in the company’s ability to navigate market challenges and capitalize on long-term sector growth.

ADES Scores Backlog of $7.17 Billion

On the other hand, ADES Holding reported a backlog of $7.17 billion as of March 31, 2025, indicating a slight increase from previous periods. Dr. Mohamed Farouk, CEO of ADES Holding, highlighted the company’s strategic focus on long-term fundamentals, operational agility, and financial discipline.

Farouk said, “While we remain mindful of ongoing global economic uncertainties, our strategic focus positions us well to capitalize on emerging opportunities. Our high-performing fleet and strong tendering activity in key markets support sustainable growth and profitability over the long term.”

With a solid financial and liquidity position, ADES Holding is poised to execute on growth opportunities, deliver shareholder returns, and expand globally. Farouk expressed confidence in the company’s ability to sustain strong performance and drive growth in the years ahead.

Embracing Sustainability in Offshore Drilling

As the industry grapples with climate change concerns and the energy transition, offshore drillers are exploring low-carbon technology options to reduce emissions and enhance sustainability. From LNG to hydrogen and biofuels, companies are investing in cleaner fuels and carbon capture technology to minimize their environmental impact.

Both Shelf Drilling and ADES Holding are committed to advancing sustainability efforts and decarbonizing their operations to meet evolving industry standards and stakeholder expectations. By embracing innovative solutions and strategic partnerships, these companies are paving the way for a more sustainable future in offshore drilling.

Overall, Shelf Drilling and ADES Holding’s proactive approaches, robust financial positions, and sustainability initiatives position them as leaders in the industry, poised for long-term value creation and growth.