Drillship Demand to Surge in U.S. Gulf in 2026, Westwood Global Energy Reports

As idle rig times loom in the U.S. Gulf this year, Westwood Global Energy, an energy market research and consultancy firm, has pointed out that the supply, demand, and utilization for drillships are set to pick up the pace in 2026, with long-term fundamentals in the offshore drilling market painting a picture of busy times ahead for the drillship fleet in the future.

Cinnamon Edralin, Westwood’s Americas Research Director, has provided a deep dive into the state of play within the U.S. Gulf drillship sector, which is said to be facing a lull in activity not seen since 2018. With marketed utilization for this segment staying above 90% since mid-2021, Edralin claims that near-term availability in the region has been very tight.

As several units are poised to roll off charter this year without follow-up jobs lined up yet, this pending drop-off in activity is steep in Westwood’s view, carrying within itself the potential to see the region’s utilization rate decrease to 70%. The marketed utilization stood at 100% from October 2021 through April 2023.

Moreover, marketed committed utilization, which Westwood defines as units available for work that are either currently under contract or have a future contract in place, is 91% for drillships in the U.S. Gulf as of early March 2025. Since several units are poised to roll off charter this year without follow-up jobs lined up yet, the pending drop in activity is perceived to be “steep” and could see the region’s utilization rate decrease to 70%.

Edralin pointed out: “The US Gulf counts many of the world’s highest specification drillships among its fleet and generally commands some of the highest dayrates in the world for units working in benign waters. The region’s total drillship supply is 23, all of which are marketed. Three of the region’s drillships are 6th generation units, and two are the world’s only 8th generation drillships outfitted with 20,000psi BOPs and other equipment for high-pressure, high-temperature wells.

“The other 18 are 7th generation units. Drillships used in the region tend to have high hookloads, dual 7-ram BOPs configured to meet US regulatory requirements, and dual activity drilling, among other capabilities.”

Currently, two ultra-deepwater drillships, the seventh-generation Deepwater Invictus and the sixth-generation Noble Globetrotter II, are not working, with the former undergoing preparations ahead of its next three-year contract in April 2025. On the other hand, Noble Globetrotter II last worked in April 2024.

In addition, Westwood notes that the Noble Globetrotter I sixth-generation drillship’s contract is firm until around April. However, the pending options could keep the rig going into August, placing it in danger of becoming idle this year alongside its sister rig, Noble Globetrotter II.

“Noble Corporation recently noted that it has effectively removed these two units from competing for drilling work, instead focusing on bidding the two rigs into well intervention programs and other select opportunities,” highlighted Edralin.

Furthermore, the seventh-generation Deepwater Conqueror and Noble Valiant are also on Westwood’s list of rigs facing idle periods potentially starting around April, even though the former already has another job lined up with a target start date in October that will keep it working for another year, leaving a gap of several months between its assignments.

According to Westwood, the seven-generation Noble BlackRhino and Valaris DS-18 units are due to roll off hire around August, followed by West Vela and Stena IceMAX in September, without any of the four drillships confirming new work bookings so far. If the region reaches the fourth quarter with seven units off-hire, this would drop the marketed utilization rate to 70%.

Edralin explained: “Because the drillships in the region have such high specifications, moving them to other regions would typically result in them not using their full capabilities, thereby lowering the dayrate potential they can command in the US Gulf. Currently, global demand outside the region does not support an influx of very high-specification drillships for term work.

“Therefore, we expect most of the units that roll off charter in the US Gulf this year to remain in place for opportunities on the horizon for 2026. Market chatter currently suggests the region may see the departure of one of the lower-specifications units if new work in the US Gulf is not confirmed.”

Dip in demand set to have short lifespan

While Westwood believes a combination of factors, such as rising overall project costs, not just rig day rates, and continued supply chain challenges that mean some long-lead items are taking longer to arrive, are behind the sudden near-term gaps for so many units, the company is convinced the lull will be a short-term dip in activity in the U.S. Gulf region.

Edralin elaborated: “Further complicating the landscape in the US Gulf is the shrinking number of active operators. In 2015, there were 17 active operators that used one or more drillships during the year. By comparison, in 2024, the total number of active drillship operators had dropped to nine.

“Some of these operators have been swallowed up in various mergers and acquisitions, while others transitioned to onshore portfolios, and others simply are not currently undertaking an offshore drilling campaign. Additionally, we should consider 2015 semisub demand, which was 12.

“Over time, operator preference in the region has shifted primarily to drillships when it comes to floating rig selections. Currently, there is only one active semisub working in the region. When reviewing the list of active semisub operators in 2015, an additional eight companies not previously counted on the drillship list are added, although not all these are surviving entities today.”

Westwood underlines that some operators with pending plug and abandonment (P&A) obligations may see the near-term white space as an opportunity to seek a rig at a more attractive rate. Having fewer active operators means a decreased likelihood of several coming forward to take advantage of potentially lower-priced gap-filler slots, based on the firm’s findings.

Westwood identifies further challenges for the 2025 schedule to stem from operator budgets for this year, which have already been set, leaving little wiggle room for unplanned drilling programs, as most operators are already looking to their plans for 2026 and beyond.

Growth in drillship demand on the 2026 horizon

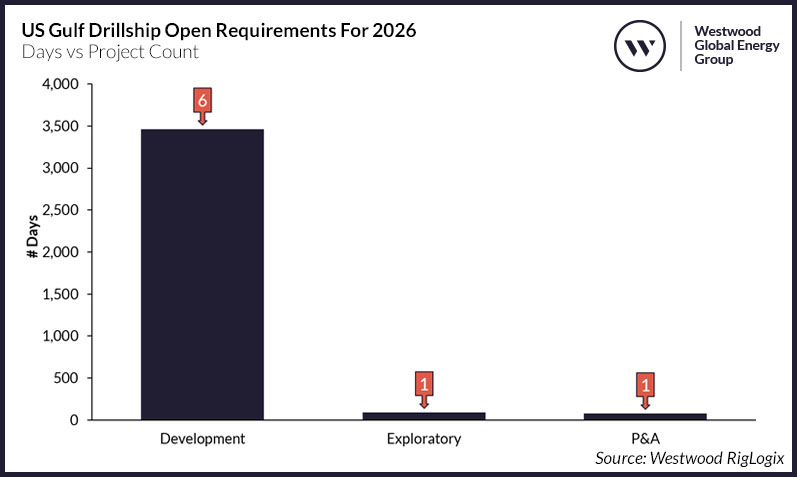

Within its 2026 demand outlook for U.S. Gulf drillships, Westwood’s RigLogix database is currently tracking over 3,600 days of work with target start dates in 2026. The firm underscores that the lion’s share of this is expected to be against the renewal of rigs rolling off charter rather than incremental work.

“Because some of the region’s smaller independent oil companies tend to run rig lines of between one and two units per year, some gaps between assignments are expected. However, as noted earlier, having fewer active operators in the region reduces the number of companies that may emerge with unanticipated new requirements,” noted Edralin.

Even though the second half of 2025 is expected to be challenging for the U.S. Gulf drillships that roll off charter, Westwood still expects most to ride out the rough waters in anticipation of more work in 2026 and a return to tight utilization.

As a result, Edralin spotlights that the U.S. Gulf will remain one of the top locations in the world for drillship activity in the long term.